I was thinking about some of the cool things I saw, read, noticed and digested around the world of tech for 2018. A bonus blog post for your holiday perusal.

You’ll notice underlying the top 10 is what I regard to be the biggest shift in tech at the moment is the realisation that we have a technology wildfire raging. We need to learn to control it and ensure that what we are building serves the many, and not just the few. We can do it – but first we must understand it.

So here it is, the Sammatron’s Tech Top 10 for 2018…. enjoy:

- Blog Post of the year: Survival of the Richest by Douglas Rushkoff, who contends that the one percent are plotting to leave us behind. It’s a compelling read that unearths the dangers of the schism between us and the one percent.

- Podcast Series of the year: The Dream by Stitcher is a brilliant review of the history of Multi-Level Marketing (MLMs), pyramid selling and their total dodginess. Think Amway. The thing I found most compelling is how hackable the human mind can be when an organisation is selling ‘hope’ instead of an actual product. The ironic thing about these MLMs is that the philosophy they sell is all true (in relation to business success), but the business model they attach to it is a total fraud. And that is their trick. A mind blowing story that is very well researched.

- Podcast Episode of the year: Joe Rogan’s interview of Dr Ben Goertzel. Dr Ben Goertzel is a mathematician and leading Artificial Intelligence researcher. They go deep on everything that matters on tech and our future. Ben might just be the most informed, intellectual, articulate, compassionate and humane individual I’ve ever had the pleasure of listening to. It’s two hours of wonder. The world is lucky to have people like Dr Goertzel in it.

- Book of the Year: Winner Takes All by Anand Giridharadas. The elite charade of changing the world. This book couldn’t come at a more important time in our history. It’s the one book I’m recommending at the moment. In this book Anand explains from the inside how the emergent global elite pretend to try to ‘change the world for the better’, but in doing so really just obfuscate their desire to preserve the status quo and their role in causing the problems they pretend to try and solve. Jaw-dropping stuff.

- Documentary of the Year: The Cleaners by Hans Block and Moritz Riesewick is a timely film which investigates the shadowy and disturbing world of content removal from popular social media sites. An ugly underbelly of outsourced, low-paid workers deciding on whether a beheading constitutes news, free speech or inappropriate content. Another reminder that these are not technology companies but media organisations that are long overdue some serious regulation.

- Software of the year: Well, it’s more a shift than a singular piece of software – the Low Code / No code app movement. This is the arrival of software platforms that allow anyone with basic computer literacy to develop software or apps without any coding expertise. Put simply, if you can read, you’re about to become a software developer too. An important evolution for the masses where software is eating everything

- Tech Fail of the year: Crypto currency price crash – Ok ok, this is actually good – it means we can now focus on the important technology which underpins it – Blockchain. I actually believe that this is a bit like the Dot Com crash in 1999-2000 and is almost a pre-condition for crypto and blockchain to be everything it can be. Yes, it will come back even stronger.

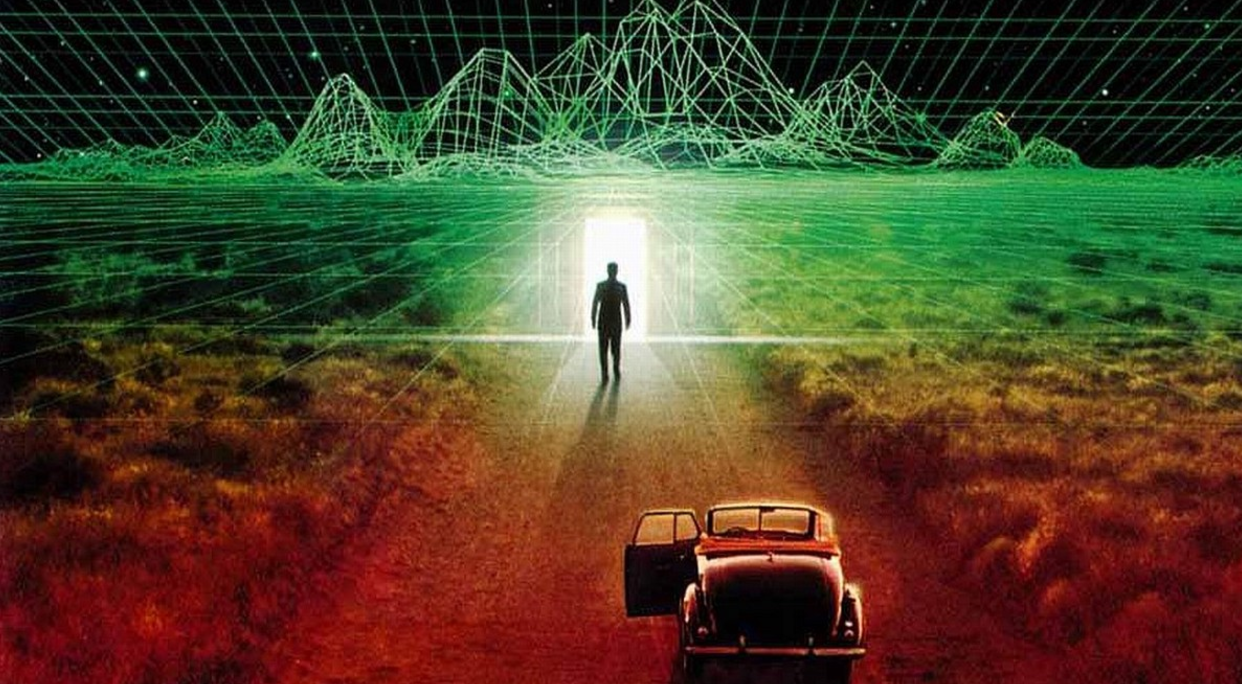

- TV Show of the Year: Black Mirror. In fact, it’s not even close – it’s Black Mirror and daylight. By far the most insightful and important TV series in decades. The most recent episode Bandersnatch just snuck into 2018 a few days ago. If you haven’t seen it, then do yourself a favour.

- Smartphone App of the year: Surprise….None, zero, zip. I can’t think of one, and I checked my phone too. None have been good enough in the past 2 years to even make it onto my device! Actually I lie, a new parking app in my city Melbourne called PayStay is quite useful, but it’s more a reflection of our city being 5 years behind the times than an innovation. It’s another reminder that the halcyon days of app development are over, and that the real game in the coming few years is beyond the app economy. It’s probably worth looking at your own phone – I’m certain you’ll also be underwhelmed about how little it’s changed in the past few years.

- Technology Shift of the Year: The move to Voice as a primary interface. It’s early days – but I believe it is under-hyped and will replace the screen as our primary interaction in years to come. Don’t forget, language is Humanity’s killer app. Best you get onto it now.

—

Have a great 2019, Steve.