It’s pretty easy to forget how much a new technology changes our lives once it’s adopted. Sure, some new technologies are like shooting stars, but some change everything forever. So, for posterity’s sake, I’ve laid out a list of new technologies that changed how we do things, and maybe even the direction of our species. Enjoy!

2010

What happened: Google leaves China + Uber launches in App Store

Why it mattered: Google leaving China was the start of a New Cold War. China pushed hard to create clones of Western online services and even made better ones – see WeChat. This time the Cold War isn’t an arms race, but a race for quantum and data supremacy. The weird part is that USA and China both surveil their citizens, though the Chinese government isn’t making a secret of tracking their citizens, while the USA is pretending it’s about security when clearly it’s not.

Uber hitting the App Store was about much more than putting taxis on notice for terrible service. It was the start of the immediacy economy – anything and everything on demand, delivered to wherever we happen to be. The start of a massive GPS-driven logistics and mobility revolution.

2011

What happened: Twitch is launched + Steve Jobs dies

Why it mattered: For the uninitiated, Twitch is an online streaming service to watch people play video games. If it sounds ridiculous to you, then just remember that in many cultures we gather in giant stadiums to watch teams of adult humans dressed in co-ordinated attire kick dead animal skins through white sticks (football). It really was the start of the meta-economy where online activities are starting to gather layers and blur with the ‘real world’.

The death of Steve Jobs cemented his legacy as a quasi-Jesus figure for tech fans the world over. The problem was this created a dangerous idolatry of any innovation big tech companies launched at us. From this, the negative externalities have been ignored for far too long – including the massive issues we are now facing with Big Tech’s monopoly powers on par with nation states.

2012

What happened: Facebook buys Instagram for $US 1 billion + Tinder launches

Why it mattered: An open and fair internet took a massive hit when Facebook bought Instagram. This was the start of a serious economic consolidation of power while regulators were asleep at the wheel. The fact that we have a single ‘media’ organisation – and yes they are a media company – with massive influence over 2.4 billion constituents should make all of us lose sleep at night.

We’ve been finding mates online and in personal columns for decades, but Tinder normalised digital as a preamble to the physical meetup process. Meeting online went from weird to just plain ordinary.

2013

What happened: Edward Snowden’s NSA revelations + Facebook goes public with IPO.

Why it mattered: Snowden’s revelations of a mass surveillance programme targeting US citizens was the first time the wider population saw the downside of digital. While most people still don’t care, or at least act like they don’t, it did signal that privacy and security will eventually become the workplace health and safety of the modern era. If we are fortunate, it might spawn a new industry to protect our civil rights, while society and lawmakers catch up with the the reality of the risks.

Facebook goes public. Interestingly, its founder and CEO Mark Zuckerberg sends a letter to shareholders claiming that its mission of connecting (controlling) the world is more important than profit – but he fails to mention in said letter that he can never be removed from office or voted out. Just think of this: Mark Zuckerberg is in control of more people than anyone, ever, in history. To date, its market capitalisation has now increased fourfold since the IPO. Welcome to the Zuckerberg Dynasty.

2014

What happened: Facebook buys WhatsApp + Amazon Echo is launched

Why it mattered: It’s strange to me that Facebook was able to make an acquisition valued at $US 16 billion and still not capture the attention of antitrust regulation. They also said it was ‘impossible’ to integrate FB and WhatsApp services and data. Then, just like magic, they were able to do it a couple of years later, lolz… see 2012 above.

The launch of the voice services with Amazon Echo will be remembered in the future as the time when we truly started to communicate with AI. This was that moment. This will be when it got real.

2015

What happened: Google driverless vehicle hits the road + SpaceX lands first rocket

Why it mattered: When Google (now Waymo) put its driverless car out for all to see on a real road, industrialists sat up and took notice. We realised that cars were very quickly becoming rolling computers, that the digital world now shaped the physical world too. That was the moment that every business knew it too was now in the technology business.

The Space Race was once the exclusive domain of Big Gov. After a few decades of neglect, it has been miraculously revived as a private industry. If anything – this should signify the era of the bodacious billionaire where they have as much (or more?) power than elected governments.

2016

What happened: Donald Trump elected President + Theranos implodes

Why it mattered: In my view Trump is an inevitable symptom of crazy times and a radical pace of change. But it was the moment the wider world realised that news isn’t news anymore. We all live in echo chambers of existing belief systems and our minds can be hacked by the power of algorithms.

When blood diagnosis health startup Theranos was exposed as a scam – everyone started to understand that not all unicorns would live up to their hype, valuations or even their product promises. It was time to be very aware that in the real physical world beyond photo sharing apps, it’s very important that products actually work.

2017

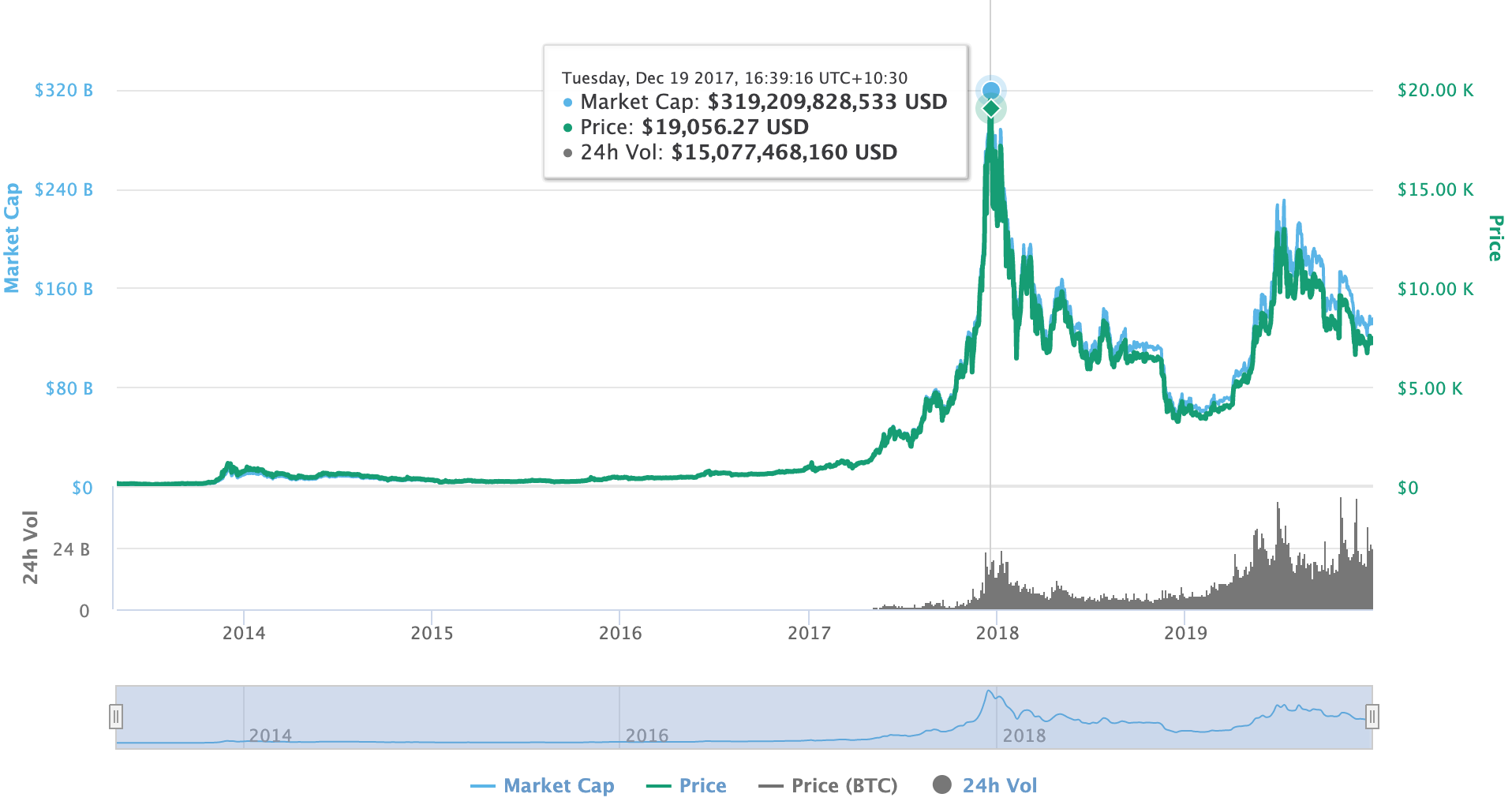

What happened: Cambridge Analytica scandal + Bitcoin bubble

Why it mattered: The Cambridge Analytica scandal particularly annoyed me because it wasn’t the Cambridge Analytica scandal – it was actually a Facebook scandal. I don’t know how The Zuck pulled it off, but it was a stunning exercise showcasing the dark arts of blame deflection.

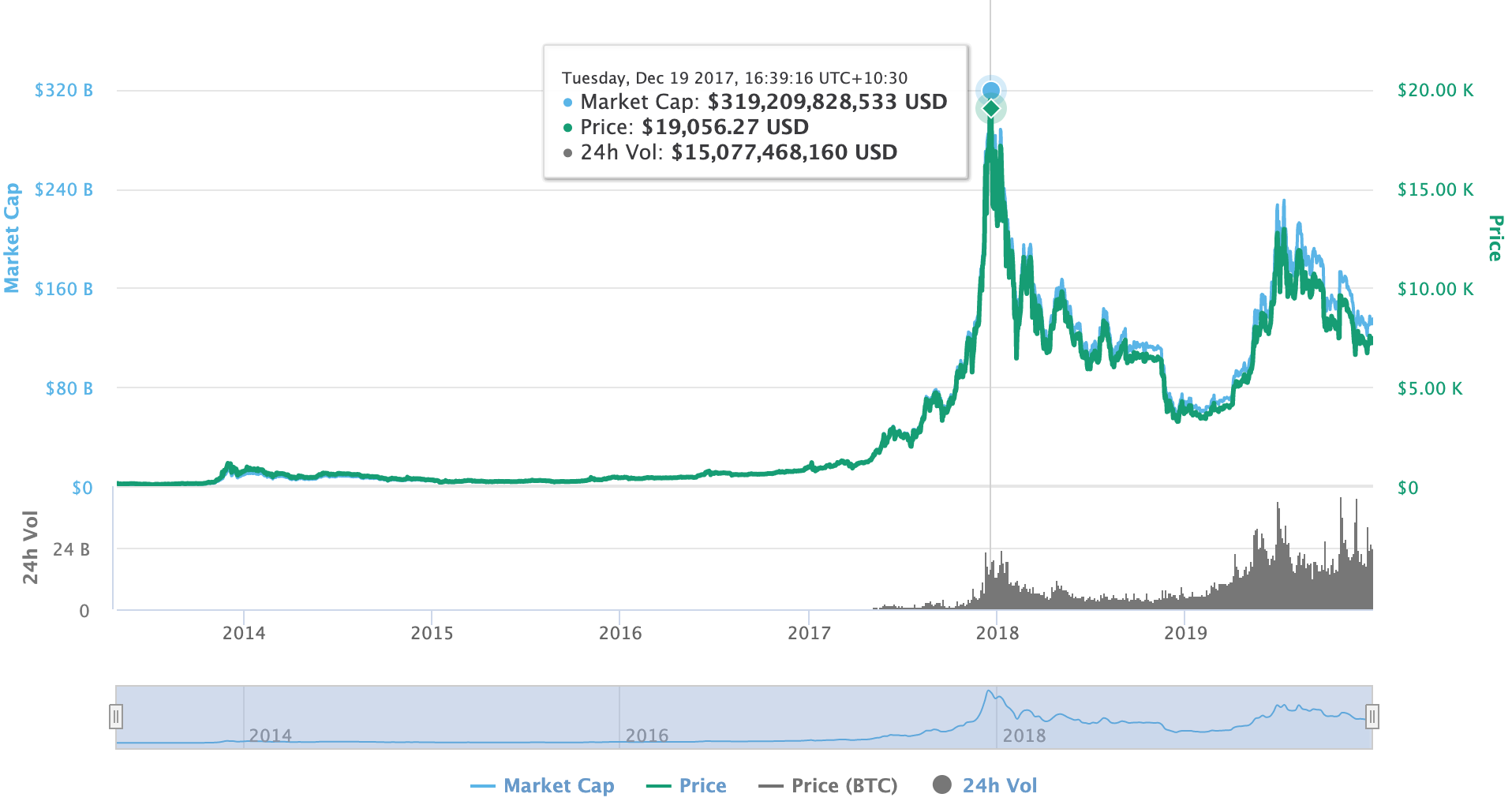

The bursting of the Bitcoin and crypto bubble was one we had to have. I liken it to the dot-com bubble of 1999. Cryptocurrency too will come back and change our lives, and this new financial system might change the world even more than the internet has.

Here’s the history of Bitcoin price:

2018

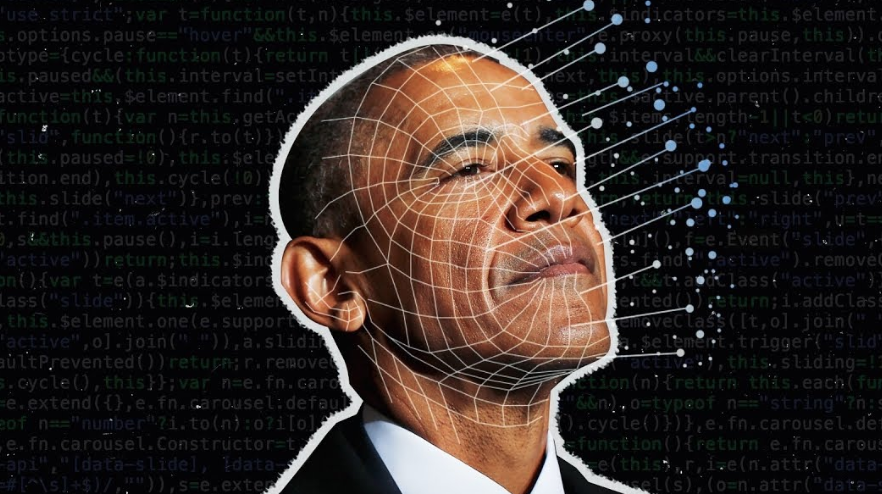

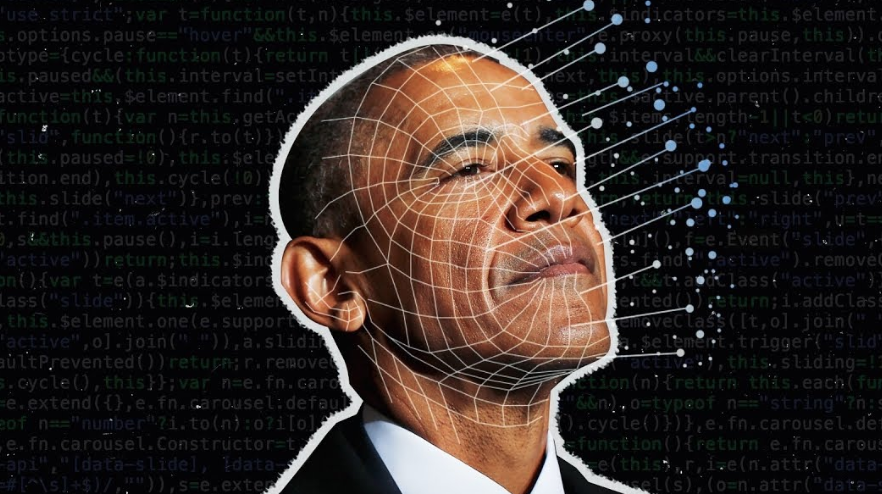

What happened: GDPR + Deep Fakes arrive

Why it mattered: The EU’s General Data Protection Regulation (GDPR) put surveillance capitalism on notice. While the opening gambit was small and probably affected the competitors of Big Tech more than those it was aimed at, it was the start of a movement to give power back to the people.

The first flurry of deepfakes hit the world and blew minds. But just wait until they are free and anyone can do it. It might just spell the end of audio visual truth. A few years from now, we’ll be asking people if they were actually there to prove it happened. This could put a massive schism into the entire web and anything news-related.

2019

What happened: Antitrust actions commence on Big Tech + Greta Thunberg named Time Magazine’s Person of the Year

Why it mattered: Antitrust actions taking place this year are a classic turning of the tide and the realisation we are in the middle of a gilded technopoly. The next decade will be one of regulation versus innovation – with the former taking precedence over the latter. It won’t be about stopping or slowing down technology, rather about civilising it so we can have progress for all humanity, not just the fortunate few.

Greta showed the world than even a child can command attention on issues vital for humanity. It’s amazing what can be said when words are not guided by vested interests. Here’s what I know for sure: we have all the technology we need today to have a low carbon emission economy. The kicker is that such a shift to a new energy model is probably the only way to maintain the economic growth the grownups seem to love so much.

– – –

For me this is an era where the development of technology won’t slow – but its implementation might and it will certainly be more considered, competitive and wide-reaching for whom it benefits. I can’t wait to push deeper into the next decade and help build a future we all deserve.