“What? The land of the free? Whoever told you that is your enemy!” – Zach de la Rocca, 1992.

Let me back up a little. Growing up as a child in the 1980s, America was the land of milk and honey, where dreams came true. I just assumed one day I’d move to America. Saccharine sitcoms like Happy Days, Family Ties, Growing Pains and The Cosby Show led me to believe that everyone lived in double story houses, had professional parents without money problems, enjoyed excellent health, were well-educated and that racism didn’t even exist. That was until I peered behind the curtain and saw the reality. Pre-internet it wasn’t that easy to work out what was happening in other countries, because TV, advertising and imported products were our only windows to the world. Oh how little I knew. While it seems the perpetual decline of the US is inevitable, I sometimes wonder if it were ever more than a Hollywood prop.

We are collectively viewing the end of the shortest empire in history, the United States of America. Granted, it was at one point probably the most powerful in history, yet now is crumbling before our eyes. We are witnessing a modern day fall of Rome, live.

To perpetuate an empire, three things need to be maintained:

- People need to become a little bit smarter

- People need to become a little bit healthier

- People need to become a little bit richer

The US is not performing well against these three criteria. It’s the only developed economy in the world where this is the case.

Smarter: It’s clear that the US has some of the world’s greatest thinkers and innovators. However, in recent decades, simple markers of intelligence and collective understanding of the world have declined. It’s astounding how many US citizens deny facts which are indisputable and learned in grade school. Thirty percent of millennials in the US are not convinced the earth is round. This number is only 4% for the rest of the world. In the mid 1970s at the peak of the space race, the proportion of ‘Flat Earthers’ in America was less than two percent. One third of Americans cannot name a single branch of their own government. A quarter of Americans believe that the sun orbits the earth. Twenty percent believe that humans were created 10,000 years ago.

I’ve chosen facts like these, because they should be universally agreed upon. Acknowledgement of these facts frame a viewpoint of society where basic knowledge is important to shape government policy and to address vital issues like climate change. (Coincidentally, of which a quarter of Americans deny.) It also is unlikely that the US can educate its way out of this mess. Access to education in the US is bad and getting worse. Student debt as of April 2022 was US$1.75 trillion dollars. The average debt to education costs per household is US$57,520. The cost of higher education in the US has outpaced inflation for 4 decades. Before anyone even gets to college in the US, they need to fight their way through an incredibly difficult K-12 system, where the amount of money the government spends on a local school depends on how much the houses in the areas are worth. The higher the real estate prices, the more funding local schools attract. If you think this sounds like something from a Black Mirror episode, trust your instincts.

It’s hard to pinpoint exactly how and why the US, once the bastion of global intelligence, is experiencing such a decline. I can’t help but think that the past two decades where, from Fox News to Facebook, the spread of misinformation in the media has significantly contributed to the dumbing down their society.

Bonus: if you want to get smarter – Catch up on The Rebound TV here.

Healthier: For the first time since the industrial revolution, America has witnessed a decline in life expectancy. They lost 2.26 years in the past year alone. This is at a time when medical advances (and terrific things like vaccines) have never been more advanced and available. They suffered more deaths due to Covid than any other developed nation, which is now pegged at more than one million people. They have the lowest vaccination uptake of all developed nations, currently ranking 64th in the world. The crazy thing is that they spend more on health than any other developed nation. They spend US$4.1 trillion on health annually – US$12,530 per person – which is increasing at 9.7% per year, yet for the worst health outcomes. (Most of the spending goes to insurance companies.) They are the most obese nation in the world, with 42.4% regarded as clinically obese. In the year 2000, this number was just 30.4%. For the first time in their history, children are not expected to outlive their parents.

The opioid crisis in the US is at such epidemic levels that it killed over 100,000 people in 2021 and it is getting worse (in 2020 the opioid crisis was responsible for 78,000 deaths.) In contrast, over 45,000 people died last year from gun-related injuries. (Yes, you can still buy guns at Walmart.) It’s ironic that the Supreme Court is allegedly considering overturning Roe v. Wade (the right to choose abortion). It seems like protecting lives is only important before they exit the womb.

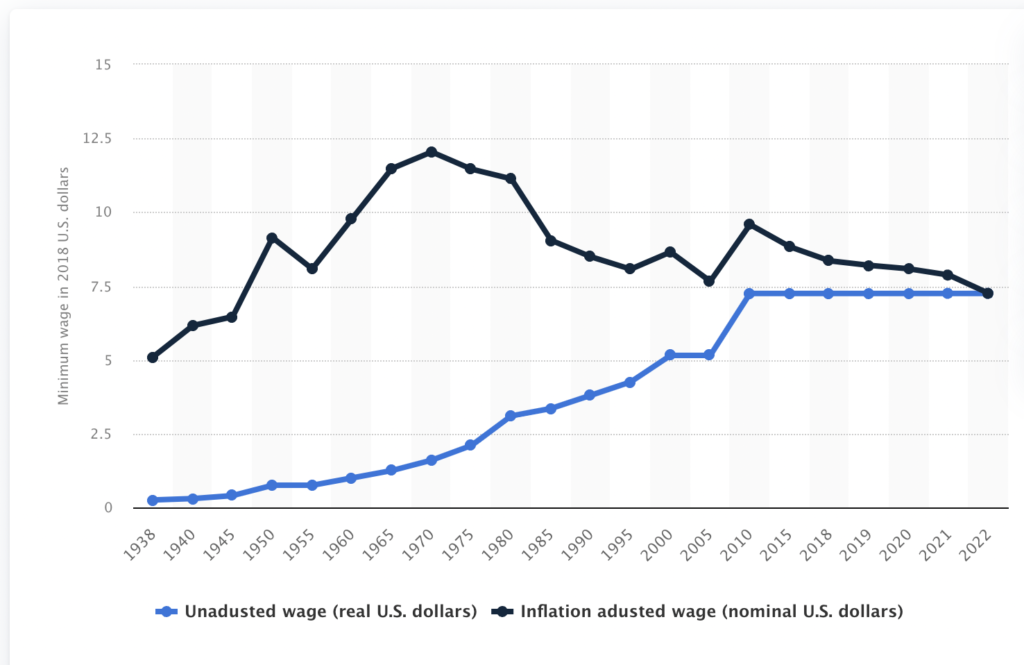

Richer: The minimum wage in the US is currently US$7.25 per hour. If you think that sounds bad, it’s worth noting it hasn’t increased since 2010. When adjusted for inflation, the minimum wage in the US is lower than it was in 1970.

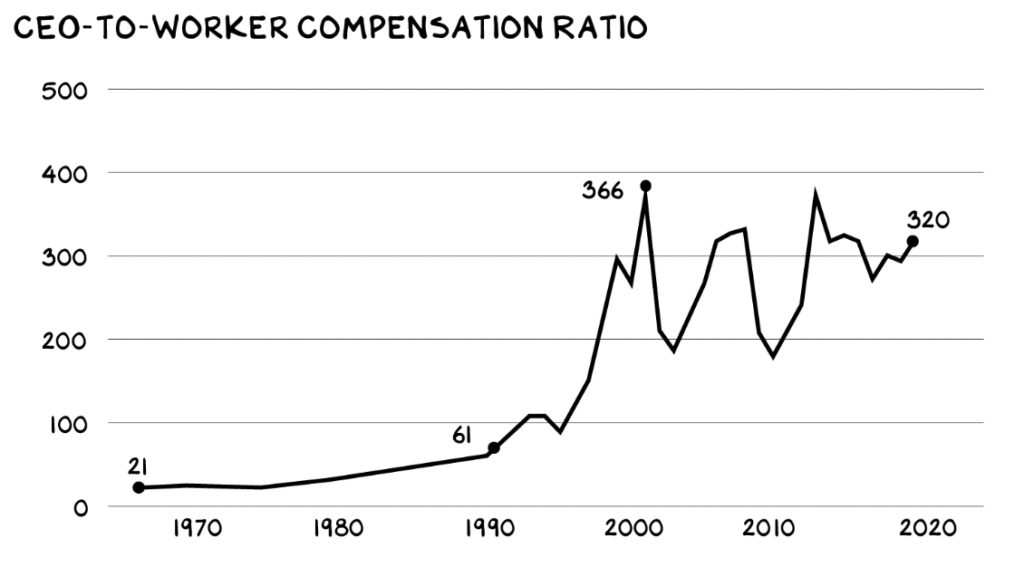

Meanwhile, CEO wages have increased exponentially. The average CEO wage in the US is now 320 times more than what workers earn. In 1970, it was ‘only’ 21 times more than the average worker’s.

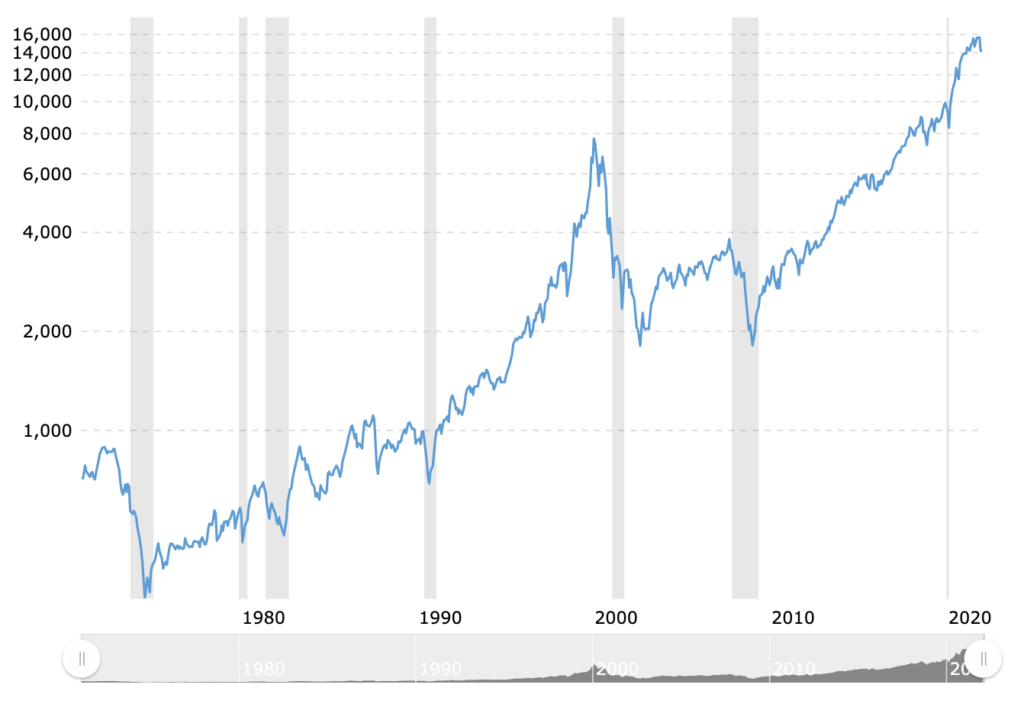

Unfortunately, this isn’t just about the disparity between CEOs and people working for minimum wage. The general rate of income inequality is increasing rapidly. Five families in the USA now have as much wealth as the bottom 50% of the population. It’s insane, and a lot of it can be tracked back to the narrative proselytising lower tax rates. Lower taxes, it was claimed, create jobs and growth, but all it really does is transfer wealth to the owners of capital. Few people know that the highest tax rate in the US was 94% in 1945. Today it is 37% and you need to earn over $500,000 before you hit that rate. Meanwhile, corporate tax rates are a mere 21%.

The effect of this isn’t just the hollowing out of things like education and healthcare. Income inequality is exacerbated which then creates a spiralling down effect. People can’t access resources for health and eduction, while the wealthy can, so the gap grows bigger.

All of this is happening at a time when the cost of living is increasing and the country is becoming more socially divided.

When the core tenets for a stable society of health, wealth and education are eroded from the bottom up, it rarely ends well. History says that it causes instability, infighting and eventual civil war. TL;DR: people come with pitchforks. I wouldn’t be surprised if the USA splits like the USSR did. Never before have we seen such an economic powerhouse so divided on both beliefs and the foundations that actually hold it together.

—

Keep Thinking,

Steve.