At time like these no one has all the answers as to what’s next. What is useful however, is asking a lot of questions. The art of scenario planning and being ready for a number of plausible trajectories and future realities. So I’ve bunched them into the of categories Data, The Economy, Work and Society.

So here it is – Post Covid Possibilities from the Sammatron. Consider, discuss and debate.

The Data & Surveillance:

Digital Sovereignty – Governments around the world (excluding China & USA) will realise that they don’t have digital sovereignty They’ve essentially been colonised by ‘Big tech’ – in that they don’t own or control the most powerful tools in the modern economy – Digital Infrastructure. Hardware / data / social / search – they’ve had to rely Big Tech (Alphabet / Apple / Facebook / Amazon / Microsoft) to gain access to data to control the virus. It will (should) facilitate nationalisation of digital infrastructure and or create a desire to build out and create their own versions.

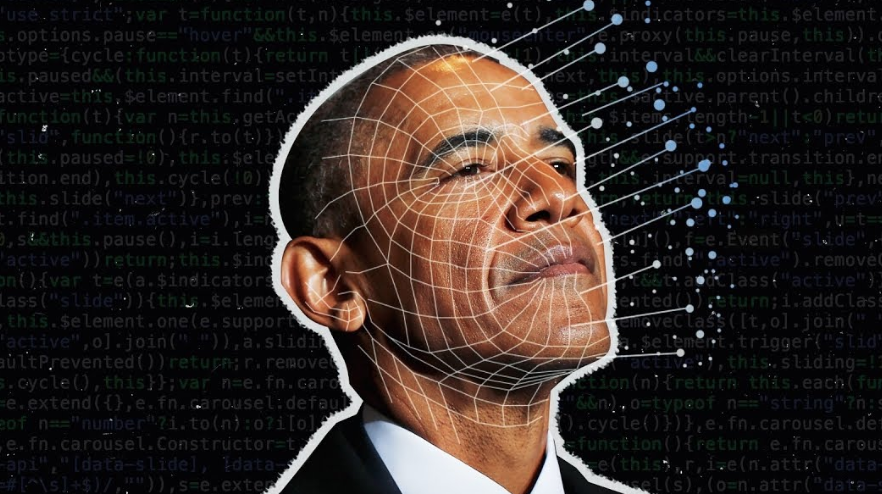

Permanent Surveillance – A new era of digital surveillance will enter the economy and become very sticky. All our personal connections & locations and data will now be a permanent fixture in Gov. databases. Providing existential risk for overreach. Algorithms matched with other existing data sets will provide near perfect summaries of most citizens.

Biometric Scanning – Will be a new norm like scanning for weapons except this time they won’t be checking for weapons outside of our bodies, but the weapons inside our bodies – potential viruses and infections. Biometric testing will be present on public transport, stadiums, schools, universities and workplaces. We’ll walk through temperature sensors, breathe into analysers, look into iris scanners and be monitored by any other device you can imagine.

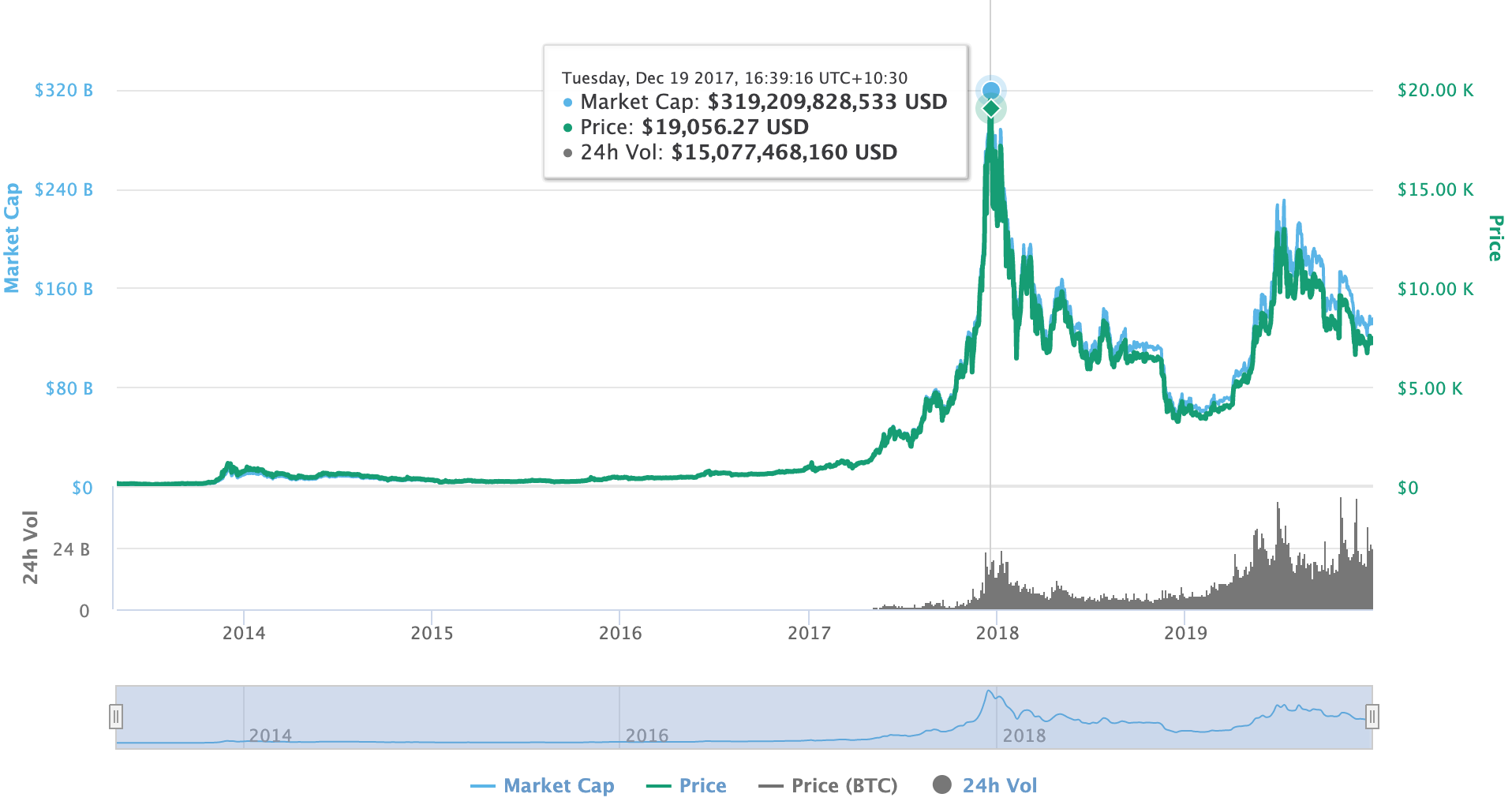

Big Tech Anti-Trust – Governments around the world will realise that they had to go cap in hand to big tech to use their resources to implement tracking and report on the covid situation. They are the only sector to have gained financial ground and market capitalisation during the crisis. This will further ensconce policy calling for their break up and or nationalisation.

The Economy:

Securing the Supply chain – There will be a push to have a stronger domestic supply chain and local production in most countries. Countries have realised how exposed they are if they don’t produce essential goods – such as food, medicine, health care materials, transport, energy etc. Local Manufacturing will make a comeback and be facilitated by new levels of A.I and automation.

De-globalisation – Married with borders being restricted and closed in many cases for an elongated period of time, we can expect a decade of de-globalisation. This shift already aligns with current US and UK political trajectories (Notably Brexit) and will accelerate the trend. Expect manufacturing and production to strengthen in home markets as a respond to supply chain risk and geopolitical and racial undertones.

Post-Efficiency Economics – Our obsession with efficiency of everything, and leaving no margin for error or ‘fat’ will be exposed as flawed. In the new economy we can expect a balance of safety to be built into systems which are inefficient on purpose so we can cope with Black Swan events such as COVID-19.

End of the Consistent Taxation Decline: The Ragan inspired era of reduced tax and trickle-down economics will be exposed as a lie that favours the rich and drives inequality. Due to necessity taxes will be raised globally regardless of what Liberal and Republican governments currently claim. We’ll realise that tax actually provides a base for economic stability and severely needed structural investment.

Nationalisation of Infrastructure – A new form of civic federalism will emerge. We’ll start to revalue to importance of infrastructure not run with a profit incentive, but the service incentive of the populace. Starting with Healthcare & Education, people will realise natural monopolies like Energy, Roads, Public Transport, Telecoms, may be better held in public hands. We’ll start to value access and control of critical infrastructure as the fabric of a civil society. A renewed respect for our trusted Institutions will also emerge.

A New Frugality – In both business and consumer spending. Financial fear associated with more frequent shocks will reduce the incentives to take on debt and aim for capital growth. This will impact corporate investment, consumer spending and house prices. The end of mass consumer culture could eventuate. A post-depression era style conservatism could emerge. The economy will be driven more by yield, than growth.

Bailout Pushback – Citizens will rally against the Gov. bailing out publicly traded stocks, and call it out for what it is Cronyism – or shall we call it – Corporate Socialism. This time the crisis has really hit street level and any bailout of a failed firm that isn’t an essential service will be heavily derided. This crisis jump start traditional two way capitalism, The take your wins, and swallow your losses – the antithesis of the GFC – where private profits and end up public losses via bail outs.

The Philanthropic Charade Exposed – billionaires who use philanthropy as a PR strategy will be exposed as the fraud they are. The tiny percentages of the wealth they offer up, pale in comparison to what they ought be paying in taxes, and the fact that philanthropy falsely allows rich people to decide where we need the money, (Choosing to give where it suits their business & political interests) instead of letting Gov. allocated their resources. All the while generating political favour for them.

Work:

Shrinking Offices – Companies will realise they don’t need as much office space. They’ll loosen the reigns on where office staff work, and take the financial advantage of having smaller offices people can come to for interactions and meetings X times per week. They’ll have collaboration spaces, not cubicles. This will negatively impact city real estate prices. The work from home revolution will accelerate.

Front Line Workers – Increased respect for healthcare workers has emerged, but sadly those in low skilled front-line work (grocery clerks, warehouse workers, drivers et al) continue to be put at risk with little safety considerations and zero financial recourse. We can expect logistical front end workers – the unsung heroes of COVD-19 – to push back hard and maybe even ask for danger money. Could unions re-emerge to protect gig workers?

Teachers, Nurses, Paramedics, childcare worker Revaluation – Social carers of the informed, young and sick might finally get the pay and respect they deserve, at a minimum they’ll have a stronger argument to their cases forward. We can live without many services, and these aren’t on the list.

Telemedicine Gets Real – Covid-10 will been seen as the long overdue birth of telemedicine. Our current necessity has provided proof that many of our healthcare needs can be performed remotely – firstly with GP consults going online– and eventually with robotic surgery becoming normalised.

Scientific Community – Expertise will start to get the respect it deserves. Even though some politicians have been working against their advice in many cases. Because this case is real, and has an immediate and direct impact (bodies piling up) – the truth will emerge that scientific advice must be adhered to in a modern society. We can hope that science will usurp the idolatry of celebrity and billionaire philanthropy. Throw us a bone why don’t ya Bezos!

Social Impact:

Personal Space – The handshake and kiss hello, and even the Bro Hug might evaporate from society. It’s already being espoused as a good time to stop it forever by healthcare experts. We can expect post corona social interactions to only be quasi-physical.

Increased Authoritarianism – Given the fear and solution authoritarian rule game to the virus, it opens a space for the acceptance of authoritarian rule. We’ll shift away from hyper individualism and the corporatization of society. We’ll revalue structure, control and certainty of risk avoidance.

Strengthened Family Units – Extended family lock downs will strengthen the value we put on the family unit and provide a war like and permanent bonding experience which will be generational and strengthen the value we put on the nuclear family. Historical evidence suggest that authoritarian regimes have stronger family units as a counter balance.

Digital Divide Exposed – COVID has exposed a digital divide amongst demographics. The most financially disadvantaged workers are also those who can’t work from home, and tend to be customer facing. Home schooling has also created a dearth for less well-off families whose kids lack access to basic technology to assist in home learning. This will become a focus of Gov. to ensure internet access and access to portable hardware such as laptops becomes part of the standard educational resources provided by Gov.

Re-Birth of Essentialism – Covid-19 have proven everything outside of food, housing, energy and healthcare are largely optional. By learning what we can live without a new era of essentialism will both be a cause and result of the new post covid frugality.

Decline in Celebrity Culture – The moved towards essentialism, will be a start reminder of the little value celebrity adds to our daily live. With a lack of production qualities in their covid-19 media output we’ve realised few celebrities have special talents – the celebrity herd will thin and influencers will see they are the most expendable as marketing budgets get cut.

Revival of Public Spaces – The increased usage of public parks and spaces will provide a new interest in protecting these resources and upgrading their facilities.

Cracks appear in Life Optimisation Movement – The idea of Life hacking and optimisations emanating out of Silicon Valley will become exposed as a flawed way to turn yourself into an economic robot. We’ve been reminded that just being and having freedom to move around is far more important than using digital tools to track how many steps you do, how well you sleep and counting other measures our bodies already track for us.

– – –

Stay safe & keep thinking, Steve.